Wages vary vastly by area. By me- the 25 would be pretty high wages. In silicon valley, or most of california, or chicago, probably pittsburgh or philly, you couldn't afford to eat. Union or non union makes a big difference too.

That said, I kind of figure whatever I'm paying someone on their check, cost me about double that. If you're paying full health insurance, retirement, pension, union scale, figure another third more.

I'm not busting your chops here, sorry if it seems like that.

If you want to use the crane business as a example, I'm not sure I'd be the one to teach you. But I'll just put this out there, because it might help you.

I could make more $ tomorrow, in my weekly check my "business" pays to me, if I went back to working union working for someone else. Now I choose what I pay myself, so that's no ones fault but my own. But my business does pay for itself. The cranes, the shop property, insurance etc, which is building equity- ultimately for me. I may die with nothing but a bunch of worn out cranes, but I'll have fun doing it. My kids can fend for themselves hopefully by that time.

But, and here's the big one, I know cranes. I know how to rig stuff, set the cranes up, get into a bad spot, and have all kinds of $ invested in stuff that lays around my shop and I use once a year. I grew up in construction. And I tinker around with rebuilding trucks. And sometimes equipment moving projects, and do a little hauling. Do our own mechanic work as much as we can.

I don't take days off. My kids talk about our 1 family vacation. I enjoy what I do and I probably do it too much. And most guys I know in the construction industry that are small businesses put in hours even more than I do.

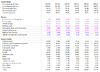

So I guess what I'm trying to say, I'm more concerned on your knowledge, and financial situation, than I am about the numbers in your chart. Because that information, will ultimately determine your bottom line.

If you can afford to buy the mulcher, and loader, and pay the repair bills, and either have the $ yourself, or can live really cheap, you can make it, if you know the business.

If you start a crane business tomorrow, with no knowledge, its going to be really tough, unless you've got a lot of other peoples money to play with. There's publicly traded crane companies and some owned by private equity firms (some of the largest are) and they just hire the experts, and play the numbers. And the biggest ones have all been in and out of bankruptcy. But I can't help you with those kind of financial game numbers.

Right now, I have a peterbilt truck in my shop that's getting a motor swapped. The next stall over sets my biggest crane, which has been down for three weeks, and probably will be for another three weeks while I'm waiting for parts from New Zealand. I've got a pickup broken down out in Oklahoma, that I tore up saturday, that I'm going to go get tomorrow and haul home, to rebuild the transfer case, and maybe the transmission too. I've got a truck in the back yard, that I'm going to turn back into a dump truck, that I spent today looking for a used bed to put on it. And that's just in between/ extra stuff, to the everyday crane stuff. And I guess I don't know how to put all that in your statement?

A small business- I've always found- the owner/ boss, really needs to know what he's talking about , or your wasting time and money. Which is fine if you have a lot of money to start with.

Can you fix the loader or mulcher if its broke/ makes a big difference on repair bills. Can you tell a customer where you can and can't get a mulcher machine, and bid a job and make $? Bury the mulcher in a swamp or tear the head up on a stand of black locust and lose a week of work and/or a big wrecker and repair bill and its now a ugly month. If you hand a customer a bill for twice the amount of time that you told him it would take, that's the last time you will work for him, or anyone he knows.

I wish it was easier for me to give you a better answer, and say "yes your chart works", or "no it doesn't" but I guess I think the business is more complicated than the flow chart, and I don't have enough info to give you a accurate number. Because I don't know what kind of losses you can stand, and what knowledge you bring.

If on the first job you do, you tear a track off the loader on a buried fence post. Can you pay the rental house for the track? If you shell the gearbox on the mulcher, or the hydraulic motor, and there's a $15,000 repair bill on it- on the very first job. Can you handle that? What if the very first week, the two year old diesel truck drops a piston, the loader goes down, and the gearbox breaks? Have you got another $25,000?

What if you hire someone, who doesn't really know what he's doing (because you don't really either) and he rolls the rental loader, and ruins it and the mower? Can you handle the $80,000?

It can be a lesson in the school of hard knocks, and I guess I'm more interested in your knowledge of that school, than what your chart shows for six years from now.